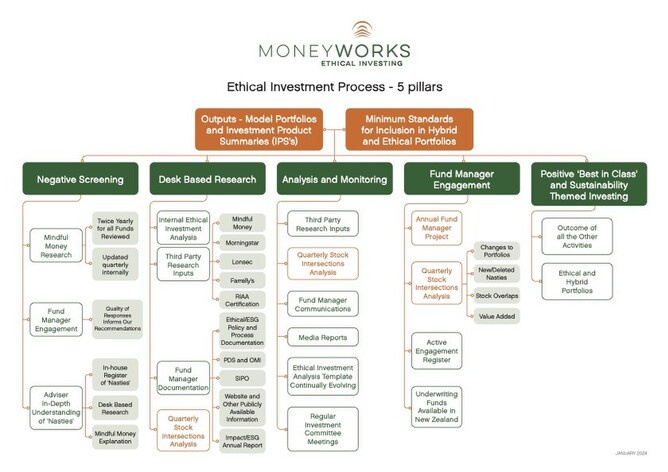

The diagram above shows all the things that we do behind the scenes in relation to investments for our clients.

One of the unique things that we do is our annual Fund Manager Project. We have been advised by a number of our fund managers that we are unusual for doing this project because a. This is usually only work done by research houses and b. We make a point of ‘actively engaging’ and giving back with constructive feedback for our fund managers, which is acknowledged and appreciated.

2024 – Communications and Third Party Research Audit

We receive a lot of information from our fund managers, some of which is excellent (and we use information to write blog articles and share with our clients), and some of which we just delete as it doesn’t add any value.

This year we completed a full audit of the communications that we received from each fund manager and KiwiSaver manager, and received some surprises. Some KiwiSaver managers don’t have any adviser communications, others have meaningless communications, but others have some really good communications.

The fund managers that we recommend in our portfolios again, range in quality of information. Some stand out as best practice across just about all categories, others are still learning how to make their mark by creating unique communications that are adding value.

Our Active Engagement philosophy is based on the fact that we expect our Fund Managers to actively engage with the companies that they are investing in, to encourage improvement with the companies operations. We feel that it is only fair that we do the same with our fund managers.

From the Communications Audit, our active engagement ranged from a half day workshop with the senior management of one of our fund managers who is developing their adviser communication suite, to a simple suggestion that instead of sending us two email newsletters each month within 10 seconds of each other with the same title, that they tweak the titles, pointing out that one is ‘Global’ and one is ‘Australasian’. There were many other engagement examples in between these two extremes and all feedback was appreciated and acted on.

In addition to the communications audit (completed by Carey), Peter and Paul did an audit of the third party research that we purchase through Lonsec and Morningstar to check whether there was anything that we didn’t already know.

2023 – Back to Basics

While the 2024 project took a total of about 60 hours between us all, our 2023 project ended up being far more time consuming than anticipated and took between 40 and 60 hours per fund manager.

We called it ‘back to basics’ and concentrated on understand the following:

1. What do you do?

2. How do you do it?

3. Who does what? And

4. What research do you buy in?

That short list of questions then evolved to a huge list of questions. We have a policy that we will see what information we can access from public and written information before asking our fund manager for more answers. Australian fund managers have an extensive document that they prepare for ‘tenders’ and that provided great information to start off with.

As a result of the project we learned a lot about each of our fund managers, built some good relationships and discovered some things about some of the investments that we weren’t thrilled about (leading to the exiting on at least one of the funds.)

The project ended up with us having those strong relationships, which means that we are comfortable communicating about any further questions that we have.

Summary

Our Annual Fund Manager Project is now a core part of our processes and business and enhances our knowledge and ability to monitor and recommend investments to our clients.

A possible project for 2025 is understanding how our fund managers are already using and planning to use AI in their business.