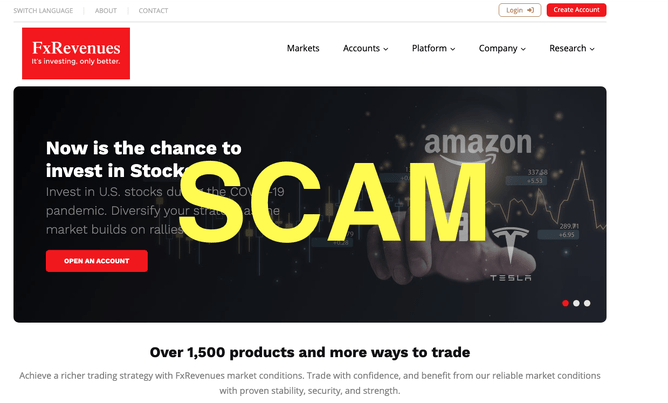

You may recall that in January 2024, I wrote an article about an investment that a client made (deliberately choosing not to ask our advice as they knew we would say NO).

Here is a link to that article https://www.moneyworks.co.nz/blog/post/113837/sexy-investment-or-an-investment-scam/.

This is an update on what has happened in the last 10 months.

Demands for more money

The client told FX Revenues that they had no more money and not to ask for any more. The client had a bad fall just before Christmas and was hospitalised for weeks and told FX Revenues this, but the demands for more money kept coming.

All up the client put in at least $100,000NZ into this 'investment'. There was a portal where the client could 'trade' and see the money going up.

Take a mortgage on your house to provide us with more money

Yes, this seriously was the demand from FX Revenues. They wouldn't leave the client alone until the client produced a letter from their bank explaining why they couldn't take a mortgage to provide more money to 'invest'. When the client told the bank about it, the bank informed them that it was a scam.

No you can't have your money out - you haven't fulfilled the terms of your contract

When the client started asking to get their money back, FX Revenues pointed to the wording in the contract that enabled them to take [pretty much an unlimited amount] from the client if they breached the terms of the contract. The contract stipulated that the client had to make so many trades every month for 12 months. My understanding of that (without being involved in the conversations) was that they expected NEW money every month to fulfil those contract terms.

Threats of legal action from the 'investment provider'

When the client said no, definitely no more money, FX Revenues said that they were going to sue the client for 'breach of contract'. Fortunately through the discussions with Moneyworks and their Bank, the client understood that as FX Revenues was not registered to operate in New Zealand (or anywhere really) they did not have legal standing to enforce the contract and sue the client.

No communication

After moving the client from their initial 'best buddy' in the organisation to another person, to another person, and escalating to another person, in the end, FX Revenues just stopped answering emails and phone calls.

So what do you do then? Because they aren't licensed in New Zealand (or pretty much anywhere) there is no legal standing to sue to get the money back (and imagine the legal fees and hassle to do that).

There is no address available apart from saying it is registered at Stoney Ground Road St Vincent (but where on that road). There is a phone number and email address, but how do you get them to engage with you?

What do you do when they just VANISH?

Money gone.

The client accepts that the money is gone. The initial exuberance and excitement of making lots of money quickly has vanished in frustration and embarrassment.

Please make sure that you or anyone you care about don't repeat this exercise. Talk to us!

I am going to repeat the points that I made in the article in January:

Please note that we are always happy to look at investment opportunities that you come across, we should be able to work out whether it is a scam or not pretty quickly (we worked this one out in about 5 minutes) and we will give you some feedback on the things you need to be aware of if we feel that it isn’t a scam.

Some important pointers from this clients experience

1. Does the organisation trade under other names

2. Understand what you are signing up for

3. Keep it secret…

4. High pressure sales

5. Is the company a real company?

6. Does the organisation have a financial services licence in all markets that it offers services in?

7. Is the offer too good to be true? Because then it usually is. [This should make an investor stop and ask – what is happening here?]

8. What are you investing in – do you understand this?

9. The two crucial questions we always ask in relation to every investment:

a. How are you going to make money and

b. How are you going to take money (ie how are you going to get your money out of the scheme?)

For more information on each of these points, check out the original article in January at https://www.moneyworks.co.nz/blog/post/113837/sexy-investment-or-an-investment-scam/

As I summarised in January - is it really worth all that stress? That is why we are here as your adviser, to help you avoid these kinds of situations. Talk to us before making a commitment. Analysing and reviewing investments is what we do and we can generally spot a fake really quickly.