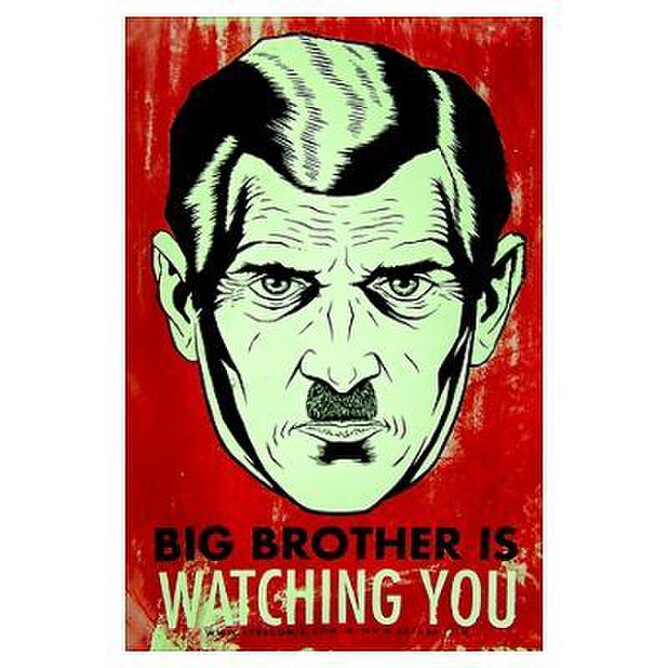

In the investment newsletters and presentations that we have read and attended over the last 5 months, the current issues of 'big brother monitoring' in China has been addressed on a regular basis.

Basically, China has extended its historic approach to 'watching out' for their people by the use of technology. An example that was quoted that particularly stuck with me was that if you were jaywalking in China, the camera's would catch you, send you an instant fine to your mobile phone while you are walking across the street, and then on one of the public screens you would be named and shamed immediately.

The situation immediately reminded me of the Black Mirror episode called 'Nosedive' where the character spends all her time looking at her social scores from her interactions with people. As she does things that irritate people, her score falls and falls no matter how hard she tries to be nice. It is scary and eerie (and well worth a watch).

This article from Fortune provides a very good summary of the situation and is thought provoking. 19 05 Chinas Dystopian Credit Scores

This article provides more context: The complicated truth about China's social credit system [Wired UK]

However, as I hear and learn more about the role of technology in monitoring people, I wonder if China is that different to other countries. In our home town Cambridge, there are now CCTV camera's down town to monitor movements and crime. But what else are they watching?

The ethics surrounding Artificial Intelligence and Technology and how it is used is becoming a significant business issue. I have two interesting articles from McKinsey on the topic - if you would like a copy of them, email me at carey@moneyworks.co.nz. The titles are The Ethics of Artificial Intelligence (which is a transcript of a podcast) and Confronting the risks of artificial intelligence.

Another relevant article that I read in detail was in The New York Times, called 'Made in China, Exported to the World: The Surveillance State'. It is well worth the read, but take into account the bias in the article.

As I was reading all of this information and listening to podcasts, I found myself agreeing whole heartedly with this comment from Jen, on The New York Times article:

"We have so readily given over our selves, our privacy and our data to technology in exchange for connection and information that we have become complicit in a surveillance culture. The Chinese did not come up with this stuff. We did. Like the iPhone. We liked having the Chinese make the device for cheap, but the device, the digital morphine - that was our idea. And in turn I think it was us who became addicted to control, to convenience, to snooping. Each of us in our small way have become masters of it. Surely the way we interact on social media, the way we rate and rank with swipes and clicks, the way we google a person we just met, means we have all become little 'big brothers' ourselves. We love getting the scoop. The dirt. Investigating and exposing. Silencing what offends or annoys us. Group shaming. We use devices as social weapons. The Chinese government concept of social credit seems so very close to what we already do to ourselves. If there is a real Big Brother listening somewhere, some digital God, we have had a big hand in making it - and it is in our own image. Our thermostat knows. So does Alexa. When I uploaded the drone app into my phone - well there went all that info. And every comment, every tweet, every date, every venmo - every - it just knows. But something in us likes it. And when someone does or says something we don't like. We now have the tools to silence them."

What do you think?