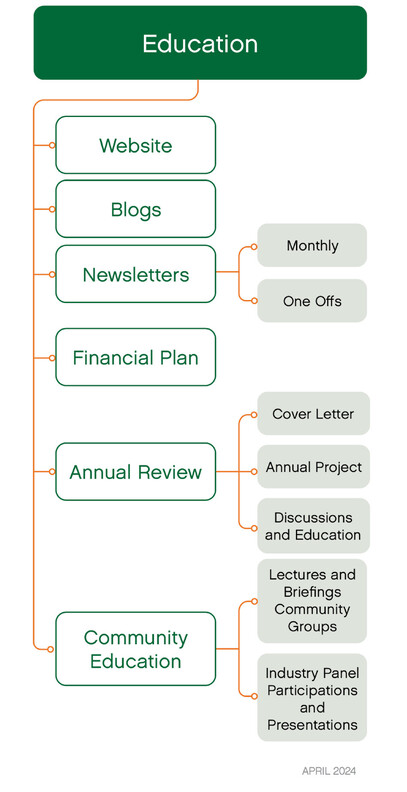

Education

The six branches of our Education Pillar

The Education Pillar has six branches of education that we provide to our clients (and the community). The most important one for our clients is our Annual Review - which we have outlined below in more detail for you .

The next five rows provide you with links to find out more about the other branches of education that we provide.

Please note, when we refer to our 'clients' we refer to our 200 Membership Fee Clients that we actively work with. We have other KiwiSaver only and insurance only clients that have chosen not to receive the annual review process in this manner, and we have not introduced our ethical process to them.

Annual Reviews

Content of Annual Review Document

Our Annual Review document is a core part of our client offering, is sent to our clients (mainly in hard copy) a minimum of five working days before our meeting and clients are aware that their role is read the document prior to the meeting. This leaves us time to talk about where they are at and share our knowledge in the meeting.

Each year we have an annual review project, in 2022 this was introducing Ethical Investing, in 2023 we are teaching our clients about how a 'top down' investment manager selects investments, and also about the latest developments in Animal Testing. Other years, we have done projects on Trusts, Cyber Security, Fire & General Insurance.

Our cover letter outlines the agenda for the year and issues that our clients need to be aware of, and is not focussed on the investment environment. To see the 2023 cover letter, click here.

To see the 2023 Annual Project, click here.

In 2024 our project is explaining our Quarterly Stock Intersections Analysis, Fund Manager Project and Stewart Investors as a bottom up manager in more detail.

These are sent to clients in January by email as an overview and then in their Annual Review document.

We have provided you with anonymised copies of the 2022 and 2023 Annual Review documents (on the buttons on the left) for you to peruse. The two documents are for the same client and have been specifically chosen because there is quite a difference between the wife and husbands approach to ethical investing - to illustrate how our personalised analysis works.

Website

Deep, detailed content on website

This website is designed to enable people to dig deep and learn about ethical investing, investing and financial planning, with the content built up over a number of years.

Blog Articles

Original content each month

These articles are written on a range of topics and are written for our clients, but available to the public. Most months there is a minimum of one article relating to ethical investing, but there can be up to four articles.

Financial Plan

Education within the plan and appendices

Our Financial Plan incorporates information from our Annual Review and other detail to assist our prospective clients with understanding our ethical approach.

Also included is the Proprietary Personalised Ethical Investment Analysis.

Newsletters

Monthly Education Newsletters

Written since 2002 with original articles, these are written for our clients (and have a readership rating of over 62%). However, we make these available publicly on the website 1-2 months after they are published and for anyone to sign up for.

One off special newsletters for clients

These are sent to our Membership Fee Clients with specific information for them. These are often about what is happening in markets, or legislative changes, or updates on what we are doing. Normally 1-3 per annum.

Community Education

Lectures and Briefings for Community Groups

As a B Corp, the community is a stakeholder in our business. We fulfil our obligations by volunteering and donating to a number of organisations (more information can be found by clicking here).

Part of our commitment to our local community is to provide education on ethical investing where requested. Carey has recently presented to the Waikato Farmers Investment Network and U3A Cambridge on ethical investing.

More information on the U3A Cambridge presentation can be found by clicking here.

Education within industry

We enjoy sharing our knowledge with the ethical investing industry and participate in panels at conferences and assist with online seminars.

We are also working with Good Returns and Investment News to educate the wider advisory industry about ethical investing, and are also reaching out proactively to other advisers in the industry to share our knowledge (and also learn) where appropriate.

Where we can, we will assist advisers with mentoring to progress their business through the ethical investing pathway.

Some of the things that Carey has done (with links where available)

Mindful Money Greenwashing seminar

RIAA Conference Panel on building portfolios 2022

Harbour Responsible Investing Panel 10th May 2023

RIAA Conference 2023 Understanding the impact of changing trends on Kiwi consumer behaviours