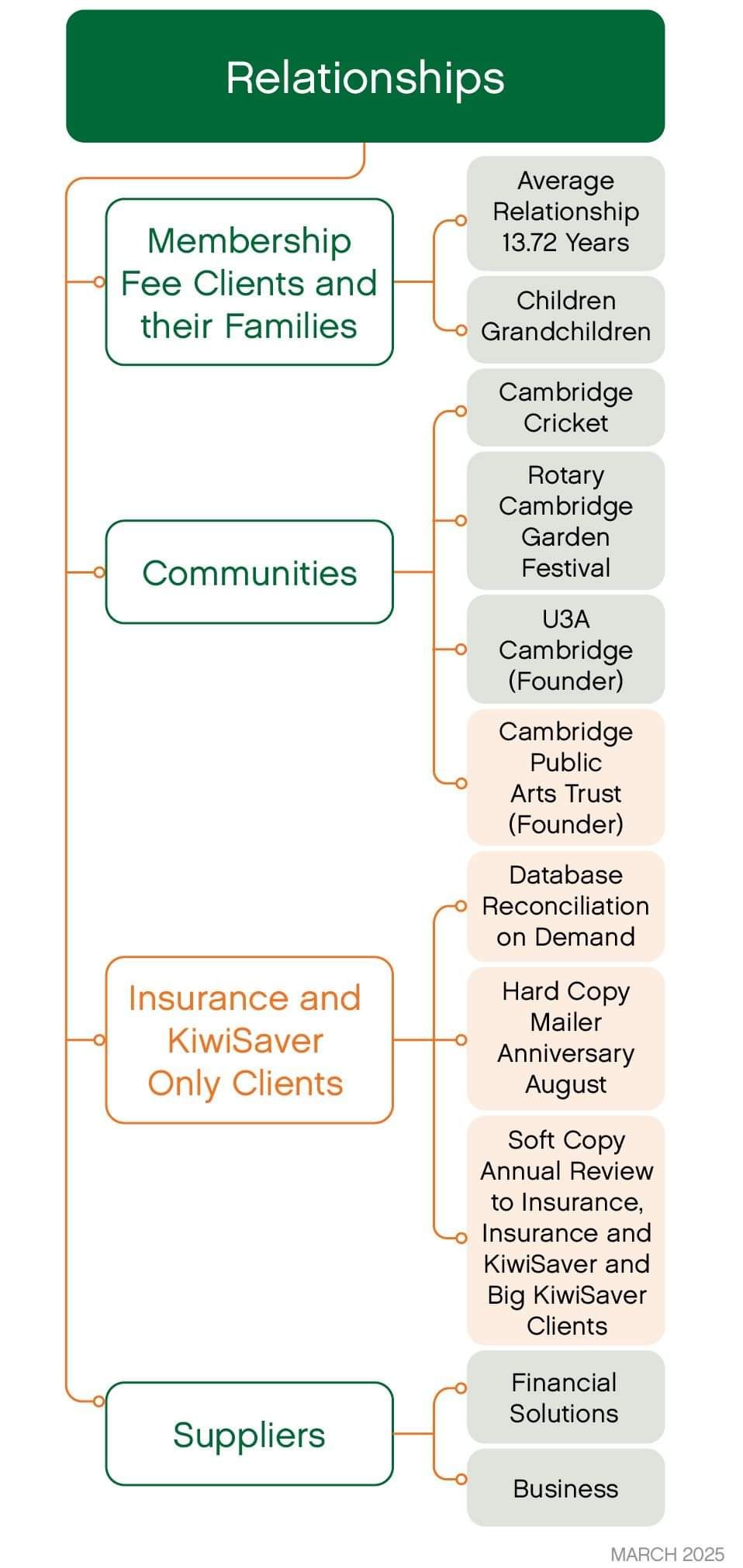

Our relationships are the key to the success of our business (which has been operating for 28 years on 14/02/2025). We pride ourselves on the longevity of our relationships with our clients and their families, our financial services providers and our business suppliers.

Clients and their families

We wouldn't have a business without our wonderful clients. When Moneyworks was established we focussed on tertiary educated, white collar professionals who were accumulating their wealth.

We work with clients that have the same values as we do, and are not reluctant to end those relationships if clients exhibit undesirable behaviour like abusing our team members.

Communities

As a B-Corp we have a commitment in our constitution to be involved in our community (both our local and industry communities), and we carry out these obligations through volunteer time as well as donations.

Our financial services providers

We work hard to know our investment and insurance providers offerings and their business and to get to know the people within the businesses. However, these relationships do not detract from our ability to change suppliers if the offerings no longer meet our clients needs.

Our business suppliers

From our professional cleaning team (who we also mentor), to our IT providers, Accountants, Fire & General providers and Legal Team, our business relationships are as important as the other relationships we have within our business.

Clients and their Families

Relationships are the key to any financial advisers proposition. Moneyworks clients are younger than the average financial planning/investment advisory business by about 10 years (60.50 years is our average age).

When Moneyworks was established we targeted people who were accumulating their wealth, which meant a slow build of their wealth, along with the development of our relationship with our clients. Our average length of relationship with our clients at April 2024 is 13.72 years, which means that we have seen our clients grow and develop, watched their children grow up, grandchildren arrive, and understand how they engage with their work, community and whanau.

It is important that we understand about any parental situations that may lead to financial and emotional stress on our clients, as well as in relation to their children (eg neuro-diversity that may mean the child is reliant on the parents for a long time.)

Given the young age of our clients, in recent years we have begun working with a number of our clients children, who are young professionals, with our clients encouraging their children to get develop and build a financial planning relationship from a young age.

The core of our meeting with our clients is learning about what they have been doing, what they want to do (their goals and objectives), their dreams and often discussing whether their goals and dreams are realistic financially for them.

The goals and objectives are updated every year in our meetings and form the core of the Retirement Savings Analysis that we personalise for clients as needed (this can be updated every year coming up to and just after retirement to give peace of mind to our clients.)

We also measure and monitor and discuss our clients understanding of the the financial advice that we are giving them, and record this in their client records, and for them to check each annual review.

We have recorded our clients next of kin (and report on this for them to check each year) and contact details since 2009, and where possible we hold our clients Wills, Enduring Power of Attorney and Trust documentation on file.

Our clients sign our meeting notes and contract of engagement each year, and receive a copy for their files, They also receive a copy of any meeting notes that we take in video conference or telephone calls, for their files.

We monitor, record and share with the team any client vulnerabilities, so that we can ensure a consistent approach when any team member is dealing with our clients. We do the same with the health situation of our clients, and report to the clients so that they can check each year.

We record all the things that happened during the year on our CRM and report it to clients each year in their Annual Review. This can be anything from things that the client has told us, to transactions undertaken in relation to their financial solutions.

Our Communities

Our communities have always been an important part of our relationships at Moneyworks, and more so, now that we have committed to being a Certified B-Corp.

A B-Corp is a business run not only for profit, but also for the benefit of our clients, team, the community and the environment.

Our geographic community

With 75% of our team living in Cambridge (one in Auckland), our focus is on the Cambridge Community. Through Moneyworks, Carey and Peter have carried out (and continue to where relevant) the following activities in Cambridge)

Carey - Founder and Project Manager of Rotary Cambridge Garden Festival from 2018 - 2023, which raised over $130,000 for the community.

Carey - Recognised with a Paul Harris Fellowship for contribution to Rotary and the Community in 2023.

Carey - Founder and Chairperson of U3A Cambridge May 2022 to present. One of the most successful U3A's in the country, with 400 members in the first 18 months and a highly extensive and successful programme of events.

Peter - Secretary and Treasurer of Cambridge Cricket, and Treasurer for Cambridge Antiques Cricket, 2021/2020 - present.

In addition, the full team commits to specified hours of volunteer work each year on projects that interest them.

Moneyworks donates 0.75% of profit to community organisations each year, which is gradually increasing to 1.00% of profit, and all team members have an allocation that they choose the charity for.

Our industry

We have a commitment to giving back to our industry community, through assisting with judging (Mindful Money Awards, RIAA awards), volunteering for participation in various panels as requested and assisting RIAA where required on committees. (Financial Adviser Certification Panel - currently on hold).

Suppliers

Our relationships with our financial services providers are important to us, and we work to understand what they are doing, and to have a two way relationship. We assist a number of our financial service providers with understanding the financial adviser world, how we work, what is important and also educate them on historic events (like the launch and development of KiwiSaver), where they may not have had experience and knowledge.

Our day to day operational relationships are also very important to us, and we act as a mentor to a number of our business services providers, developing long term mutually beneficial relationships.

Moneyworks NZ Ltd

P: 0800 225 621

E: contact@moneyworks.co.nz

7c Hall Street, Cambridge 3434

Licensed Financial Advice Provider - FSP 15281

Regulatory Information: Moneyworks is a Licensed Financial Advice Provider (FSP15281), and AML Reporting Entity and is supervised by the Financial Markets Authority.