A personalised Retirement Savings Analysis for each client to show 'how long will the money last'

This in-house built analysis provides a framework for clients to see how they are track to achieve their goals. For younger clients who still have debt, this starts off as a Cashflow analysis and tracks when the mortgage will be repaid and how much will be saved towards retirement.

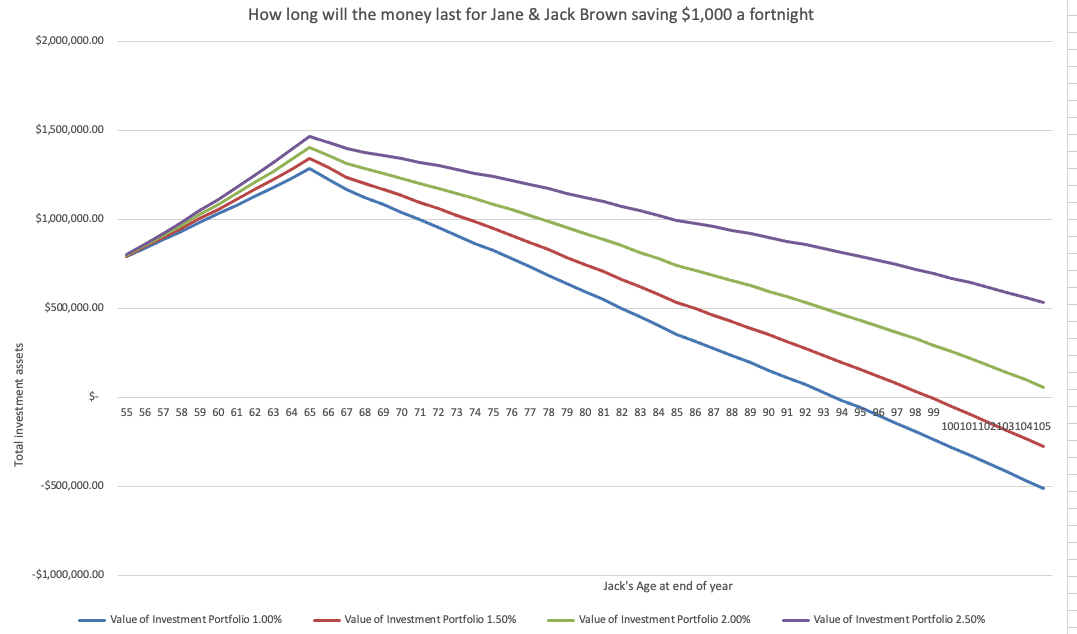

For the bulk of our clients the analysis is the Retirement Savings Analysis, which shows 'how long will your money last' depending on how much they save, spend and based on four after tax, inflation and fees returns of 1.00%, 1.50%, 2.00% and 2.50% pa.

We educate our clients about the role of inflation and focus them on the returns that they need to achieve their goals. As clients get closer to retirement, this analysis is updated every year, so that they can have reassurance that their money will last (or that they have to spend less, save more or work longer if they haven't saved enough).

Although there is quite a bit of work and assumptions included in the analysis, most clients are really just interested in the graph (shown on the left) to see when the line intersects with the horizontal access, which is when their money will run out. The amount spent and saved are variables that the clients can change themselves to look at different scenarios.