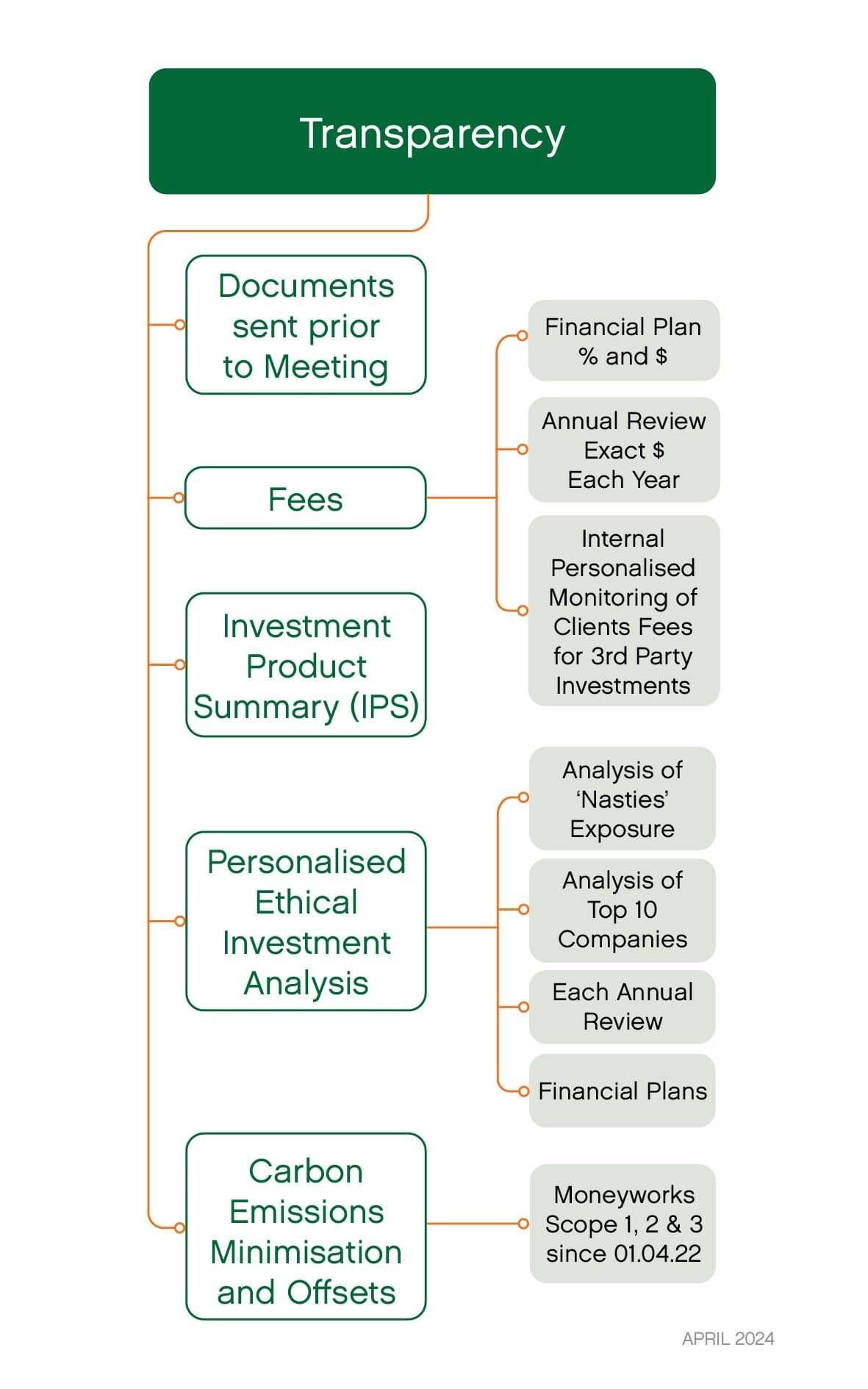

Transparency

Why do we think Transparency is important?

For us, transparency goes hand in hand with education.

If we want people to understand what they are investing in and what our advice to them is about, they need to understand what they are paying for our service, what the actual investments are that they are investing in and with ethical investing, what exposure they have to 'nasties'.

Fees and Costs

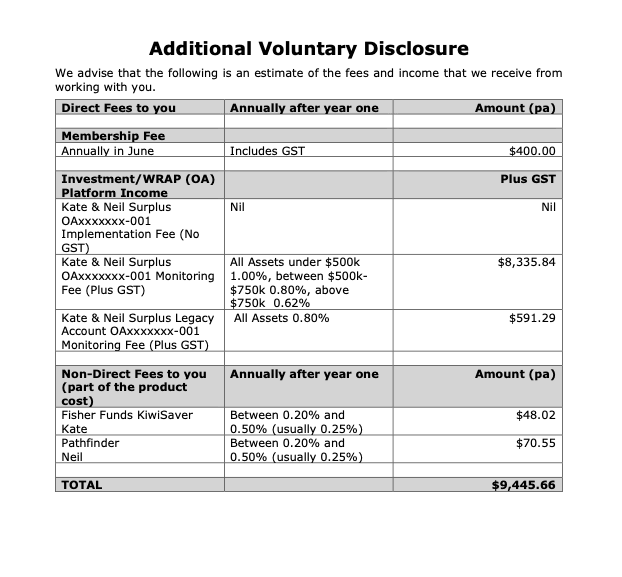

We are also market leaders in the transparency of our fees and costs. In addition to the legislatively required disclosure of fees and costs at the start of any engagement in % terms, since 2012 we have provided this information in $ terms as well. More importantly we provide each of our Membership Fee/Investment clients with an accurate report on how much we have earned in fees in the last 12 months from working with them, in $ in their Annual Review. We have also been doing this since 2012.

Since 2019 we have kept an internal record of all of our client fees received to assist us with our business planning. Since 2023 we have monitored our clients 3rd party Portfolio Fees, providing a weighted average, so that we can monitor the changes over time. This information is available to clients upon request.

Client Understanding

We ask our clients how well they understand the information and advice we give them, (on a score of 1-5) and how happy they are with that level of understanding (on a score of 1-5) and what we can do to improve that level of understanding. We are happy with the responses that we receive (which are recorded and reported to each client in their annual review document.

Millie Moneybot

We are fortunate to have built our own in-house robot - Millie Moneybot since 2018, which - as well as doing lots of our admin - enables us to do a whole lot of data analysis that would not be logistically possible for a human to do.

This enables us to provide our proprietary personalised ethical investment analysis for our clients as well as a number of other data driven analysis and reporting that benefit our business and our clients.

We have outlined our five key bits of transparency for our clients below.

Fees and Costs

What is the level of our disclosure?

Fees and Costs

We are market leaders in the transparency of our fees and costs.

In addition to the legislatively required disclosure of fees and costs at the start of any engagement in % terms, since 2012 we have provided this information in $ terms as well.

More importantly we provide each of our Membership Fee/Investment clients with an accurate report on how much we have earned in fees in the last 12 months from working with them, in $ in their Annual Review. We have also been doing this since 2012.

Since 2019 we have kept an internal record of all of our client fees received to assist us with our business planning. Since 2023 we have monitored our clients 3rd party Portfolio Fees, providing a weighted average, so that we can monitor the changes over time. This information is available to clients upon request.

Proprietary Personalised Ethical Investment Analysis

Cutting through the greenwashing

This reporting is the key that enables us to have confidence in our claims that we provide clients with Ethical investments. Using the Mindful Money research and combining it with the data crunching ability of our robot Millie, we are able to provide a personalised report for each client in their financial plan and each annual review, showing what 'nasties' they have exposure to.

With our Quarterly Stock Intersections Analysisfrom the start of 2024, we are able to update the source data from Mindful Money with known 'nasties' every quarter, providing as up to date information as possible for our clients.

This works in conjunction with our education to build their ethical investing approach and enables us to tailor portfolios if for example a client is adamant that they don't want any exposure to weapons (which has happened).

An anonymised copy of an analysis from 2024's annual review is available on the left for you to download, and the photos show the kind of graphs and tables that deliver the message.

Documents sent prior to the meeting

Why do we do this?

With an advice offering based around education, we need to allow our clients to read the advice that we are providing them with in their own time and without any pressure from us.

The standard in the financial planning and investment industry is to take documents with the adviser to the meeting to go through with the client. We don't like this approach as we feel that clients might feel uncomfortable asking questions with the adviser there and they might feel under pressure to make a decision.

We send out the financial plan for people to read and consume well before we contact them for a follow up meeting to implement the advice. We are delighted that we often turn up to that meeting and there are sticky notes and questions written all over the plan. For us that is a successful engagement.

The same principle follows through to our Annual Reviews - the key of our client offering.

We are aware that many advisers produce an investment focussed report directly from their platform providers system (and may also send six monthly or quarterly reports by email to the clients). Again, because we want our clients to read and understand what is happening, we have a different approach.

Our standard is that our clients receive the documents five working days (often earlier) before our meeting. Clients are aware that it is their responsibility to read the documentation (as much as they want to) and have the updated information that we require available to us.

The Annual Review documents are always available in soft copy in a folder that is shared with clients, so we can assist them with secure destruction of the documents at any time in the future.

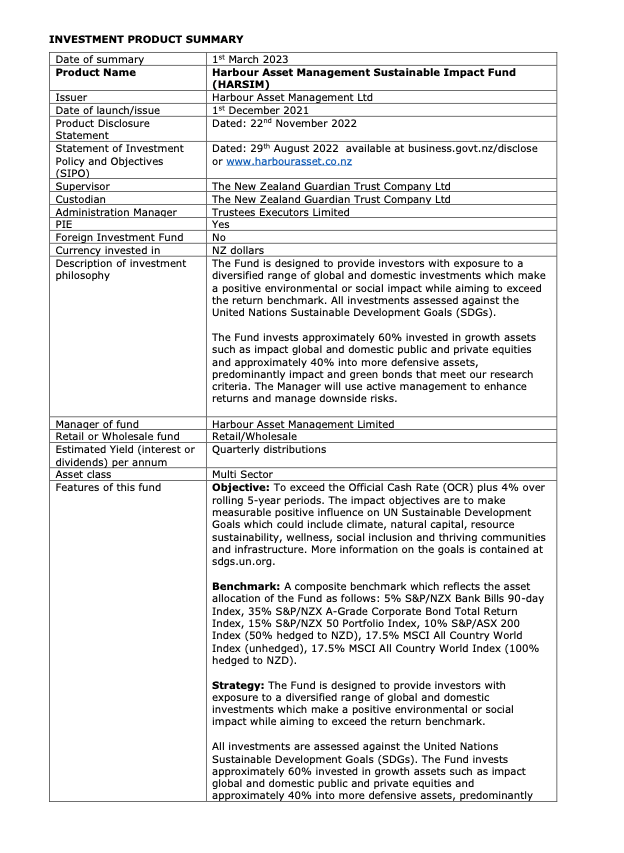

Investment Product Summary (IPS)

This is an internal document that we have prepared for our clients since 2010. This document summarises all the important things that we need our clients to know about the funds that we are recommending (particularly important following the changes to the PDS which only have proscribed information).

These were originally provided to clients at each annual review in hard copy, then on a CD Rom, then a USB Stick (still provided in new Financial Plans) and now at annual reviews by a Google Drive link.

This information includes the fees charged by the fund manager, any rebates that our clients receive, the fund sizes, the risks, and why we recommend the funds.

We aim to update these when PDS and material information is updated and are currently working on a process to automate these updates to have as up to date information as possible.

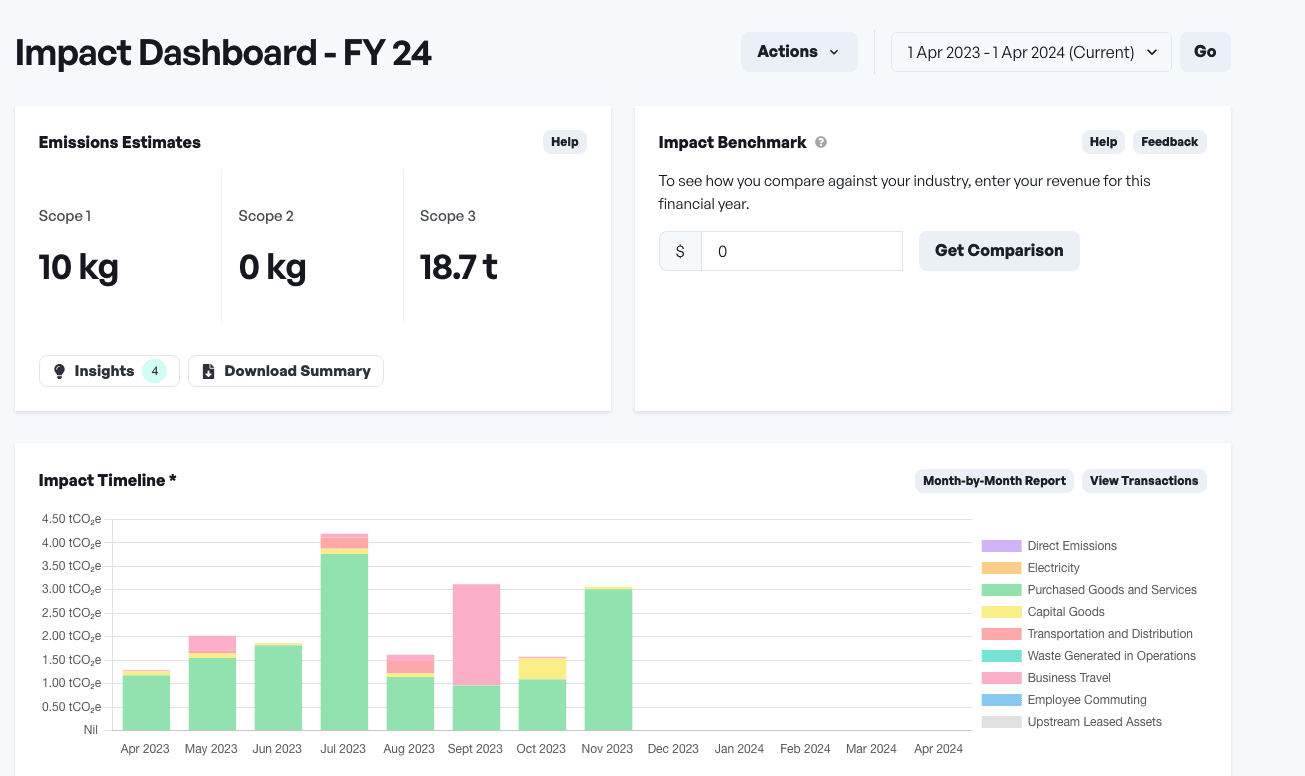

Carbon Emissions Offsets and Minimisation

Carbon Emissions Offsets and Minimisation

Being a home office based advice Business, Moneyworks do not have a lot of Scope 1 or Scope 2 emissions. However, where we can we have minimised our emissions by using Solar Power, a Net positive Electricity Producer (Ecotricity) and reducing waste by using electronic devices instead of hard copy paper for meetings.

By teaming up with Carbon Trail, which measures all of our expenditure through Xero, we have been able to offset all of our remaining emissions for Scope 1 and Scope 2, as well as our Scope 3 emissions since 01/04/2022.

Moneyworks NZ Ltd

P: 0800 225 621

E: contact@moneyworks.co.nz

P O Box 1003, Cambridge 3450

Licensed Financial Advice Provider - FSP 15281

Regulatory Information: Moneyworks is a Licensed Financial Advice Provider (FSP15281), and AML Reporting Entity and is supervised by the Financial Markets Authority.